child tax credit 2021 dates and amounts

Final date to update information on Child Tax Credit Update Portal to. Up to 1800 for each child up to age 5 and up to 1500 for each child age 6-17.

What Is The Child Tax Credit Payment Date In November 2021 As Usa

This amount was then.

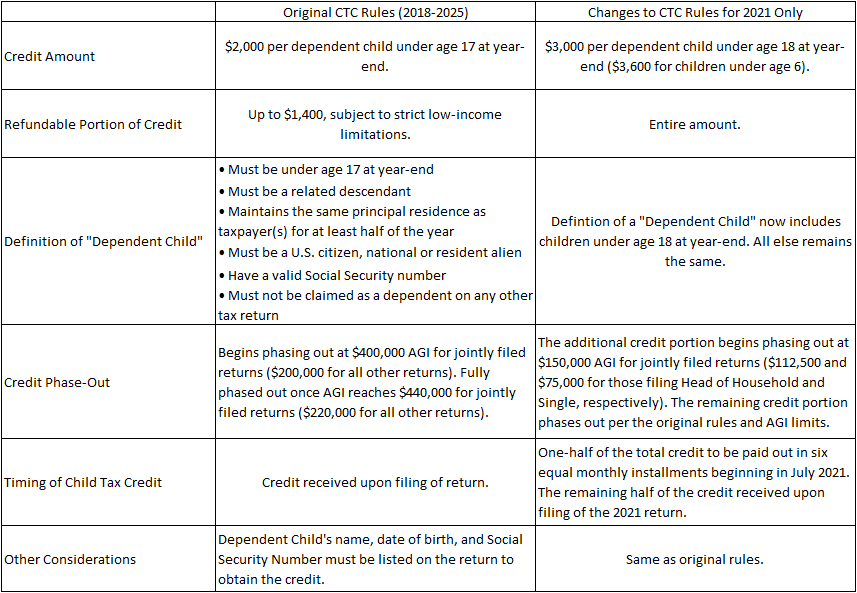

. New 2021 Child Tax Credit and advance payment details. Under the American Rescue Plan of 2021 advance payments of up to half the 2021 Child Tax Credit were sent to eligible taxpayers. A childs age helps determine the amount of Child Tax Credit that eligible parents or guardians can receive.

The IRS issued three Economic Impact Payments during the coronavirus pandemic for people who were eligible. Receives 3600 in 6 monthly. 2021 to 2022 2020 to 2021.

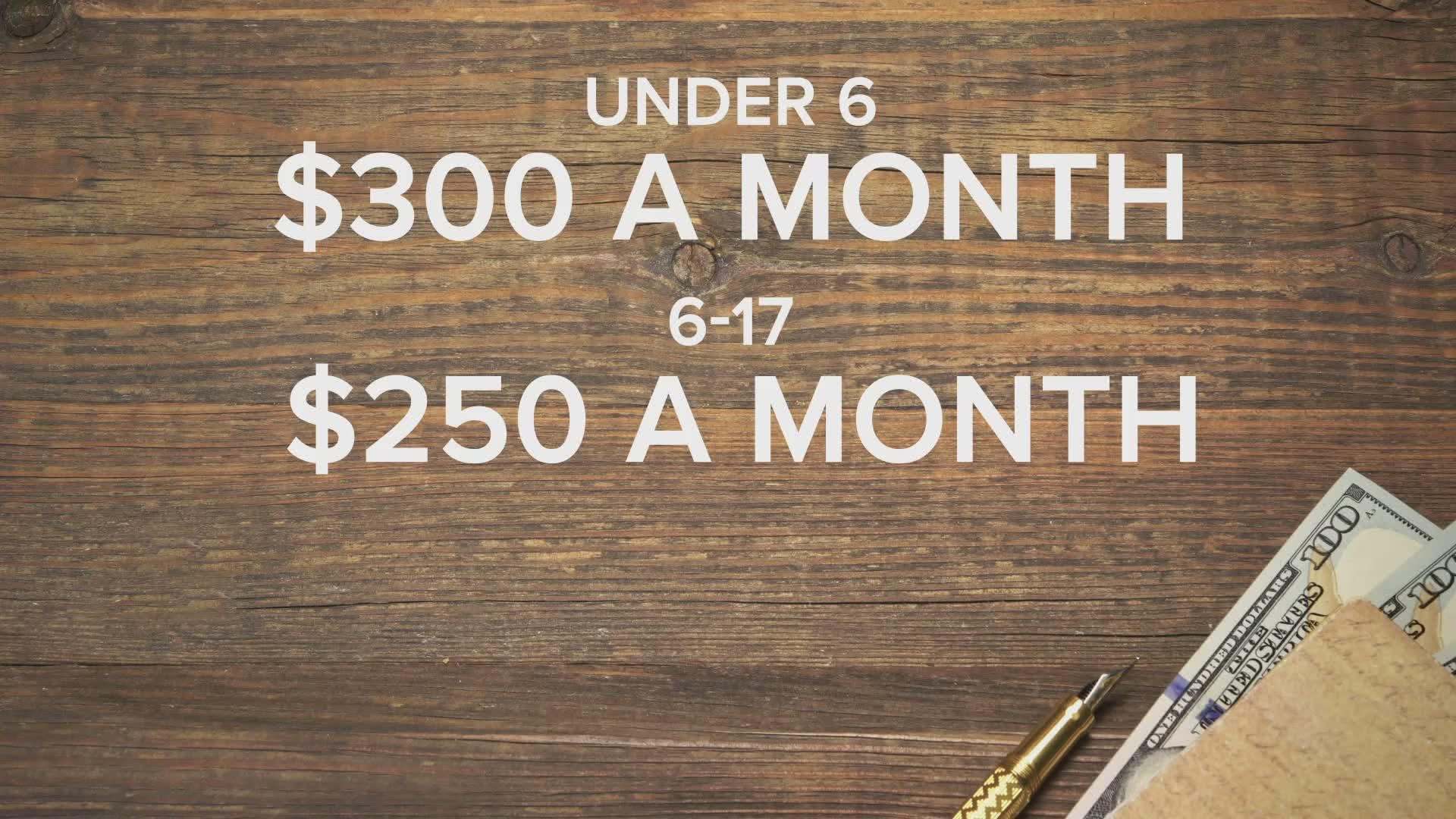

The Child Tax Credit Update Portal is no longer. Under the American Rescue Plan each payment is up to 300 per month for each child under age 6 and up to 250 per month for each child ages 6 through 17. Make changes to your income.

Child Tax Credit will not. 600 in December 2020January 2021. 1200 in April 2020.

15 opt out by Aug. Increased to 7200 from 4000 thanks to the American Rescue Plan 3600 for each child under age 6. For tax year 2021 the Child Tax Credit increased from 2000 per qualifying child to.

Child Tax Credit amounts will be different for each family. Withdrawal threshold rate 41. Make changes to your address.

Total Child Tax Credit. 3000 for children ages 6. Your amount changes based on the age of your children.

July 15 is the date for these new and expanded child tax credit payments to start. Threshold for those entitled to Child Tax Credit only. Making a new claim for Child Tax Credit.

Youll claim the other half of the credit when you file your 2021 taxes due April 18 2022. Youll claim the other half of the credit when you file your 2021 taxes due April 18 2022. The amount you can get depends on how many children youve got and whether youre.

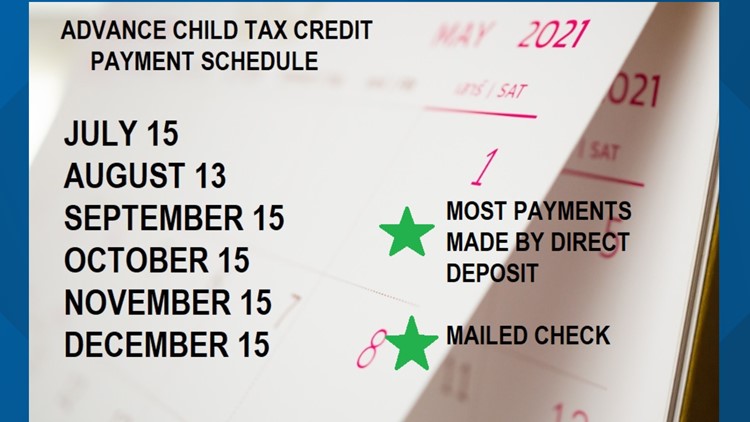

The 2021 child tax credit payment dates along with the deadlines to opt out are as follows. 3600 for children ages 5 and under at the end of 2021. To get the full enhanced CTC which amounts to 3600 for children under 6 years old and 3000 for kids ages 6 to 17 years old single taxpayers must earn less than 75000.

An eligible individuals total advance Child Tax Credit payment amounts equaled half of the amount of the individuals estimated 2021 Child Tax Credit. Already claiming Child Tax Credit. July August and September with the next due in just over three weeks on October 15.

There have been important changes to the Child Tax Credit that will help many families. The opt-out date is on October 4 so if you think it may. For 2021 eligible parents or guardians can receive up to 3600 for each child who.

13 opt out by Aug. Theyll receive the rest next spring. Thanks to the American Rescue Plan the vast majority of families will receive 3000 per child ages 6-17 years old and 3600 per child under 6 as a result of the increased 2021 Child Tax.

Three payments have been sent so far. These updated FAQs were released to the public in Fact Sheet 2022-32 PDF July 14 2022. Then advance payments of the 2021 child tax credit will be made up until the end of the year.

Up to 1800 for each child up to age 5 and up to 1500 for each child age 6-17.

Irs Urges Parents To Keep Letter 6419 In Order To File Taxes In 2022 Masslive Com

The Irs Will Be Sending Parents Monthly Payments In One Week Wfmynews2 Com

Child Tax Credit Changes Weigh The Benefits Vs Impact On Your Tax Liability Grf Cpas Advisors

What To Know About The First Advance Child Tax Credit Payment

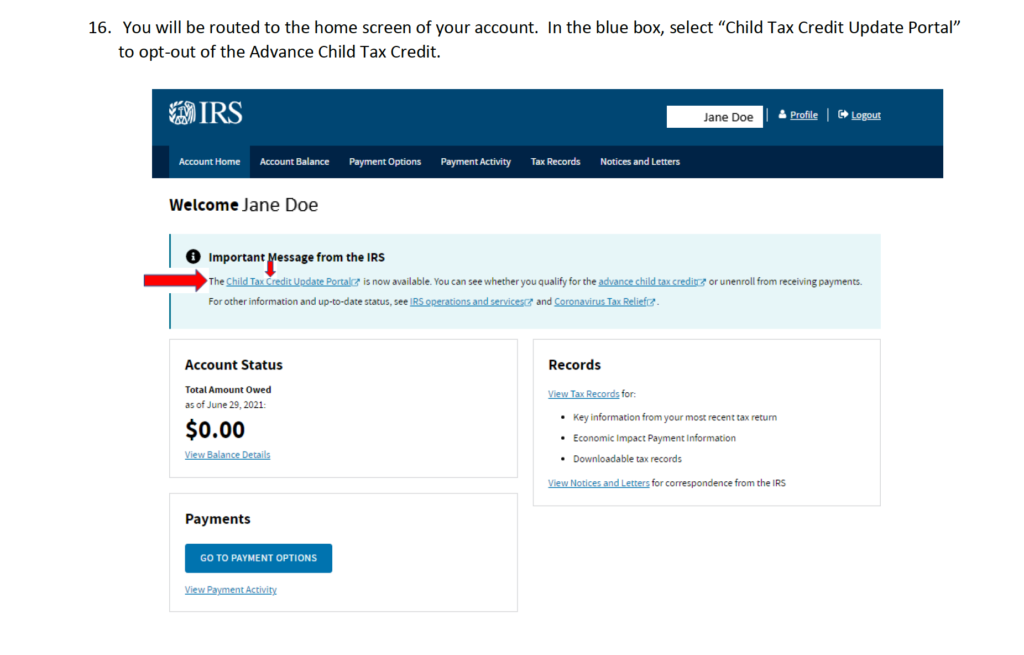

How To Opt Out Of The Advance Child Tax Credit Payments

/cloudfront-us-east-1.images.arcpublishing.com/gray/OFLFFXUVBFGBHHRPXF3OCRM7PA.jpg)

File Taxes For 2021 To Receive Your Full Child Tax Credit

Irs Child Tax Credit Letter What You Need To Know Leone Mcdonnell Roberts Professional Association Certified Public Accountants

Child Tax Credit 2021 Why Opt Out Of Monthly Payments Money

Important Child Tax Credit Form Coming For Families In The Mail Kare11 Com

Here Is Why You May Want To Opt Out Of Child Tax Credit Early Payments

Child Tax Credit What We Do Community Advocates

Child Tax Credit Don T Throw Away This Letter Before Filing Taxes Woai

/cloudfront-us-east-1.images.arcpublishing.com/gray/OFLFFXUVBFGBHHRPXF3OCRM7PA.jpg)

File Taxes For 2021 To Receive Your Full Child Tax Credit

Here S What You Need To Know About The Monthly Child Tax Credit Payments New Hampshire Bulletin

Irs Sending Letters To More Than 36 Million Families Who May Qualify For Monthly Child Tax Credits Payments Started July 15 Children Youth News Coconino Coalition For Children Youth

How To Use The Irs Child Tax Credit Update Portal Ctc Up Get It Back

Child Tax Credit Payment Schedule Here S When To Expect Checks 10tv Com

:strip_exif(true):strip_icc(true):no_upscale(true):quality(65)/d1vhqlrjc8h82r.cloudfront.net/07-13-2021/t_e69a9717b84b43d4828e335df26d1553_name_image.jpg)